Want the latest data? Download our 2026 M&A Due Diligence Best Practices study to see the latest survey results from 150 senior executives at boutique, mid-sized, and large U.S. investment banks with up to $1 billion in AUM.

How complex was due diligence in your last deal? Every M&A transaction requires it, and data shows that timelines are growing longer. To uncover efficiencies in the process, in Q3 2024 SRS Acquiom and Mergermarket surveyed 150 senior executives at boutique, medium, and large U.S. investment banks with assets under management (AUM) of up to $1 billion.

With insights from across the investment banking landscape, this report offers a comprehensive view of the major challenges and trends impacting M&A due diligence as of Q3 2024. Prominent themes include:

- Lengthening of deal timelines

- Growing focus on both technology and cybersecurity

- Reliance on virtual data rooms (VDRs) for secure and efficient processes

- Issues with incomplete or unreliable data, especially among boutique firms

The report also highlights a shift in due diligence priorities, from environmental, social, and governance (ESG) to cybersecurity—a major departure from the emphasis on ESG in recent years. This is due, in large part, to the increasing complexity of due diligence as well as mounting regulatory pressures.

Key Findings

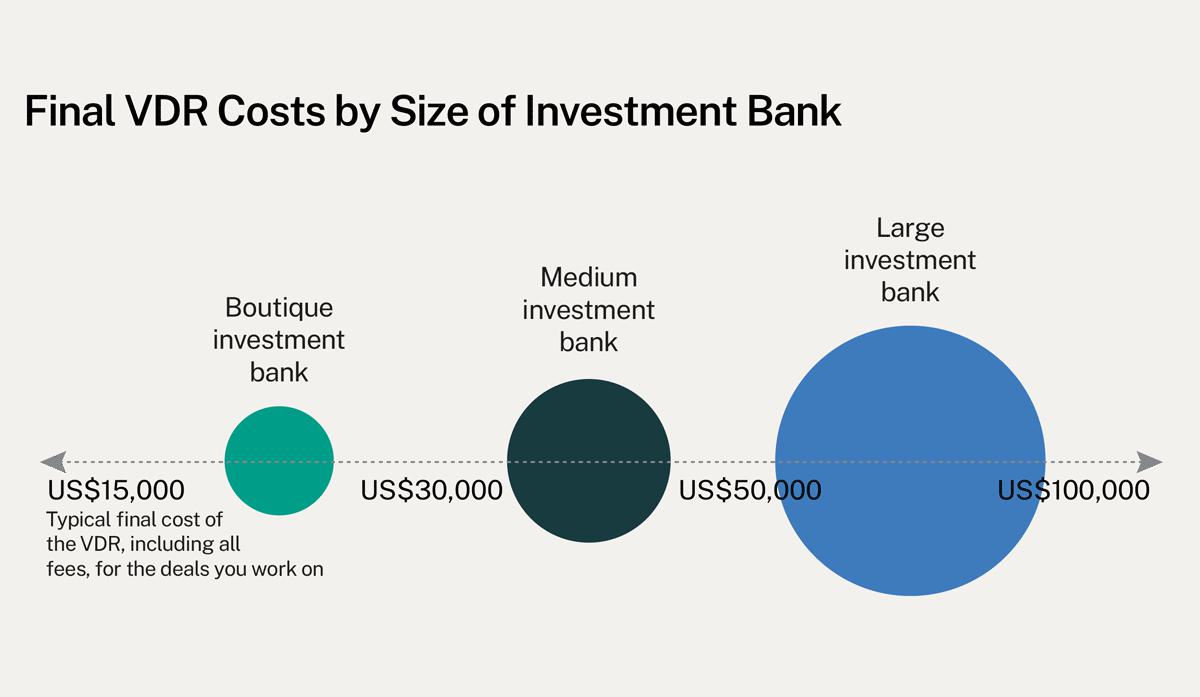

Final VDR costs can vary widely

VDRs are essential tools when it comes to smooth and efficient M&A due diligence, enabling deal teams to collaborate and manage information securely and efficiently. Among the boutique investment banks surveyed, VDRs typically cost $15,000 – $30,000, while medium-sized firms pay $30,000 – $50,000. For large investment banks, VDR costs range between $50,000 and $100,000.

How often does the final cost of a VDR match the original estimate? Find out in the full study.

Deal timelines have grown

Half of the respondents in our research indicated that it takes at least six months on average to complete a deal, from initial information-sharing to final closing. This trend is seen particularly among large and medium-sized investment banks, with 56% of participants reporting a minimum timeline of six months.

Among those experiencing extended due diligence timelines, 59% say that 1 – 3 months have been added to the process. How do these findings compare with the previous year? Learn more in the full study.

Technology diligence weighs heavily

With the proliferation of data adding significant complexity, 45% of participants in this study called out technology review as the most expensive and arduous aspect of M&A due diligence. Today the scope of due diligence has expanded to include how companies store, manage, and utilize their data, as well as where potential risks related to data privacy and security lie—a comprehensive approach that requires dealmakers to analyze huge volumes of historical data. To better equip themselves for this task, firms are using advanced analytics and machine learning tools. While these technologies add efficiency to the review process, they also elevate expectations for comprehensiveness, which can ultimately prolong data gathering and analysis.

The study reveals that 45% of respondents identify technology reviews as the most costly and onerous facet of M&A due diligence. Has this trend accelerated from the previous year? Find out more in the full study.

Missing and misleading data

As the complexity of M&A deals continues to grow, so does the importance of quality, reliable data. The study shows that dealmakers can face significant challenges when it comes to gathering and verifying information—often leading to delays in the review process. Among boutique investment banks, 40% of respondents identified incomplete information on a target company as one of the greatest due diligence hurdles in their most recent buy-side deal.

What is the biggest due diligence hurdle cited by large investment banks? Download the full study for more insights.

Soaring cybersecurity scrutiny

Among all facets of due diligence, cybersecurity is expected to receive the greatest scrutiny in the near term—cited by a massive 97% of participants in this study. In addition to identifying technological vulnerabilities in target companies, dealmakers are evaluating overall cybersecurity maturity, including the ability to detect, respond to, and recover from incidents. This is proving to be more complicated than many expected.

Get the full study to learn more about the role cybersecurity will play in due diligence over the next 12 – 24 months, according to respondents.

Access the full study for exclusive insights to help you navigate the evolving due diligence landscape with greater confidence.