Market Situation

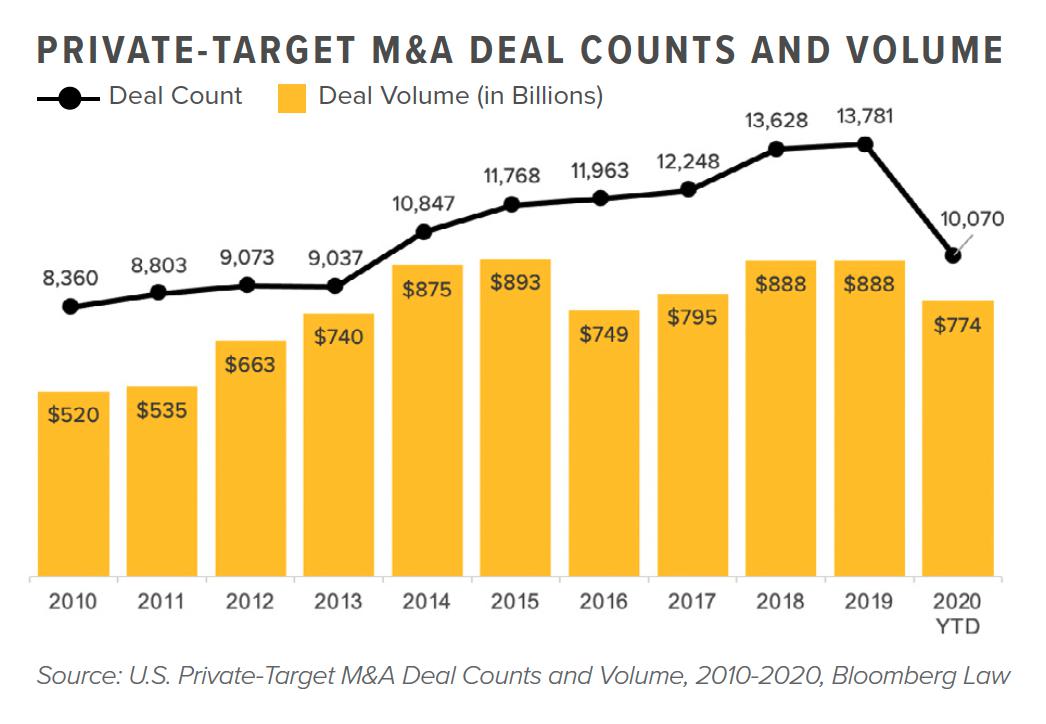

Steady increases until 2020

- Shorter overall investment periods

- More capital-raise events

- 67% increase in number of deals per year over the last decade

- 73% aggregate deal-value increase

- Increase in pro-seller terms followed these curves

Private-Target M&A Deal Counts and Volume

COVID-19: Deal terms are changing, and some impacts may last

Material Adverse Effects

- Pandemic carveouts are the norm with occasional carveouts for law compliance

Interim Operating Covenants / Reps and Warranties Disclosures

- Qualifiers for “ordinary course of business” and employment status

Purchase Price Adjustments and PPP Loans

- New guidance regarding repayment and escrow requirements for PPP loans

Earnouts

- Increase in use of EBITDA or earnings measurement versus revenue

Protect Your Negotiations & Deals

Taxes

- Opportunities to negotiate refunds (CARES Act)

- Tax audit timing is longer, resulting in delayed escrow releases

Earnout Cases

- Online clothing company: Earnout provisions require open stores and pre-COVID operations

- Pharmaceuticals: Clinical trials delayed beyond milestone deadline

Holdbacks

- Buyer’s ability to pay depends on available cash and solvency

- Solvency impacts how claims are negotiated and resolved

Stock Deals

- Stock escrows fluctuate quickly in value, further pressurizing decisions

- Similar sense of urgency where buyer stock (in escrow or holdback) is declining in value