Key Insights from Road-tested Data

What does the latest data tell us about undisclosed liability claims and earnout achievement in private-target M&A?

To answer this question, we analyzed data from three SRS Acquiom private-target data sets: the 2025 Deal Terms Study, 2025 Life Sciences Study, and the 2024 Claims Insights Report—including a fresh look at key claims data points in 2025.

This analysis centered on two key insights:

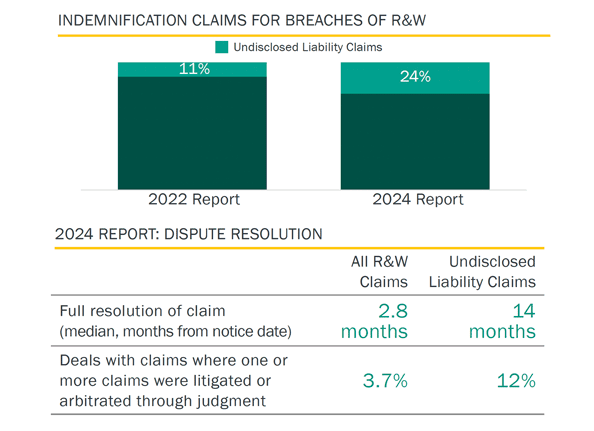

- Claims for breach of the No Undisclosed Liabilities representation are way up.

- Actual earnout achievement rates do not necessarily match seller expectations.

1. No Undisclosed Liabilities Representation

A useful instrument in buyers’ indemnification toolbox

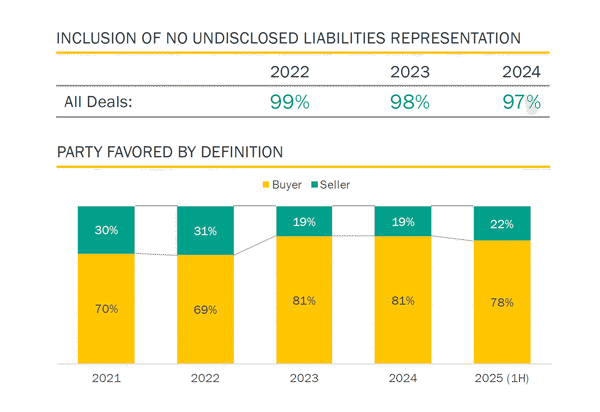

On virtually all private-target M&A deals, sellers are asked to represent that there are no undisclosed liabilities—or at least none that would require disclosure on a GAAP-compliant balance sheet. Buyers know claims for breach of this No Undisclosed Liabilities representation can be an effective way to pursue post-closing indemnification.

In today’s market, buyers typically conduct comprehensive due diligence. This contrasts with deals that closed in 2021 and early 2022, when valuations and the pace of dealmaking made such thorough due diligence impractical. The claims data below compares deals closed during that pandemic-era M&A surge to deals closed prior to 2021.

Claims for breach of the No Undisclosed Liabilities representation tell a story of buyer dissatisfaction (with high valuations paid in 2021 and early 2022) and seller confidence (in those high valuations, resulting in a greater willingness to defend such claims).

2. Earnouts (Contingent Consideration)

Proprietary data shows contingent consideration is not guaranteed.

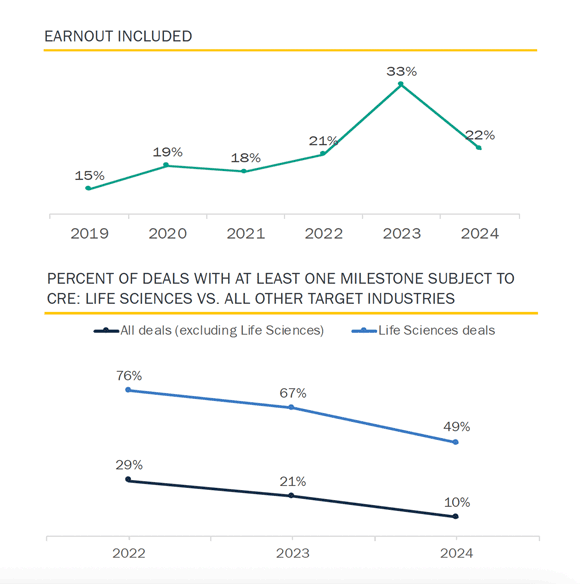

The majority of M&A deals do not include an earnout, and for those that do, most of the dollars at play never get paid. Nevertheless, earnouts can be an effective means to get a deal done, and we continue to see a slightly heightened use of earnouts following a spike in 2023. For some industries, such as life sciences, an earnout structure can even be a necessity.

Ultimately, it’s important that deal parties understand the details of any earnout provision and manage their expectations accordingly. In light of several recent Delaware court cases, there is much focus on contractual diligence standards—how a buyer must operate the target’s business during the earnout performance period.

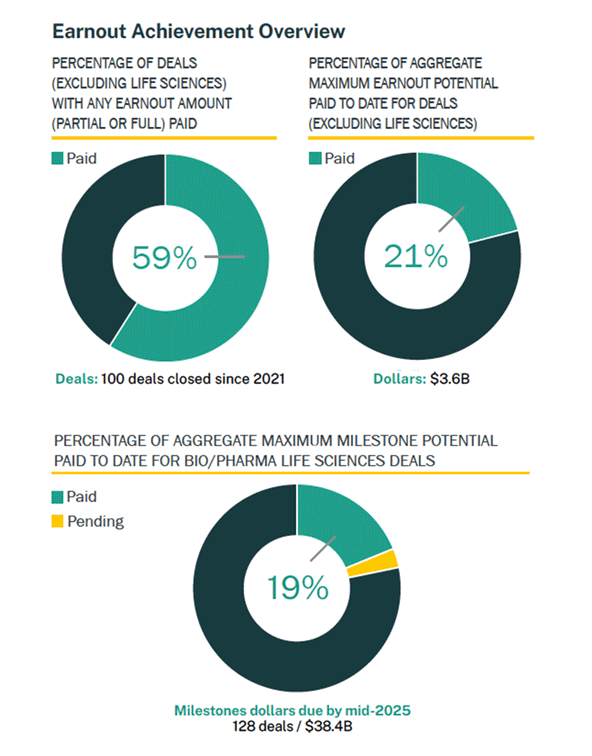

Outside of life sciences M&A, just over half of private-target deals with earnouts see some amount of payout, with most earnout dollars going unpaid.

- Lower middle-market deals (those with an upfront value of $50 million or less) generally see lower earnout achievement rates.

- For deals with some level of success in delivering an earnout, the payout amounts to approximately 50 cents on the dollar.

- When deals with no payouts are taken into account, that number drops to 21 cents on the dollar.

- In life sciences M&A, such as deals with biotechnology and pharmaceutical (“bio/pharma”) target companies, earnouts are common. They are also typically very complicated, with multiple milestones, long performance periods, and a significant portion of the deal consideration tied to them.

- In bio/pharma M&A specifically, only a small fraction of earnout dollars (19 cents on the dollar) are ever paid.

Experience and Insights Drive Better Outcomes

Combining data with practical experience yields insights that can drive better outcomes in M&A. One such insight that dealmakers know: paying close attention to even the smallest provision is essential to maximizing the overall value of a deal. To that end, the latest data highlights the increasing significance of the No Undisclosed Liabilities representation as well as earnout provisions.

Take a Deeper Dive

Explore our 2024 M&A Claims Insights Report for additional insights on M&A claim activities and earnout achievement.

Kip Wallen is a senior director leading the SRS Acquiom thought leadership practice. He leverages his extensive expertise and SRS Acquiom proprietary data to produce resourceful content regularly utilized by market practitioners. Kip has broad experience in M&A and provides guidance on market standards and trends.

Previously, Kip was a Director with the SRS Acquiom Transactional Group, where he collaborated with clients and counsel to negotiate M&A documents including purchase, escrow, payments, and other transactional agreements. Before joining SRS Acquiom, Kip was an attorney with a Denver-based boutique business law firm where he assisted clients with M&A transactions as well as general corporate governance and securities matters.

Kip is an avid supporter of the Colorado Symphony, serving as Treasurer and Trustee. He is an active participant on the American Bar Association’s M&A Committee. In 2016, Kip completed Leadership 20 with the Denver chapter of the Association for Corporate Growth.

Kip received his J.D. from the Sturm College of Law at the University of Denver and an M.S. in Economics, B.S. in Economics and B.A. in International Relations from Lehigh University. He is a member of the Colorado bar.