Post-closing preparedness is essential for a successful M&A transaction. Even after the deal documents are signed, escrows, earnouts, and claims need to be managed. An adequate M&A expense fund, set aside by the selling shareholders at closing to address claims or disputes, is key. A professional shareholder representative can facilitate efficient use and administration while ensuring sellers get the maximum benefit. Sellers should be celebrating the culmination of the M&A deal and not worrying about falling short of post-closing funding requirements.

SRS Acquiom offers perspective on best practices for expense fund preparedness.

1. How Much? Right-size the M&A Expense Fund

First ask: How likely are post-closing disputes or other time-consuming tasks like multiple escrow releases?

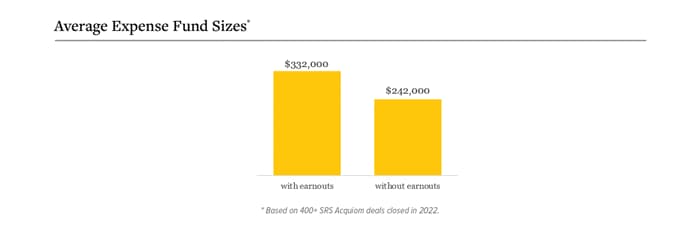

- Is there an earnout?1 A purchase price adjustment?2 Known litigation?

- How favorable are the seller’s reps and warranties and the buyer’s indemnification provisions?

Then ask: How much work will your shareholder representative handle themselves? How effective and experienced are they at efficient case management?

- Does the shareholder representative have the internal resources to address post-closing matters? For example:

- Evaluating and potentially contesting working-capital purchase price- adjustment calculations2 (or will an accountant need to be hired?).

- Evaluating buyer-prepared tax returns for the target company (or will a tax expert need to be hired for a full review?).

- Responding to and engaging in good-faith negotiations regarding buyer claims3 (or will legal counsel need to be hired right away?).

- Regularly communicating with shareholders.

- Calculating and preparing escrow release payment instructions.

- Should a formal dispute arise,3 how effective and experienced is the shareholder representative at efficient case management?

- Ensure the shareholder representative is prepared for and has a proven track record in settlement negotiations, mediations, arbitrations, and/or litigation. Experience matters when it comes to case management, such as successful appearances before the Delaware Court of Chancery and established relationships with top arbitrators and mediators.

- The average expense-fund sizes referenced above are rarely enough to get the parties through the pleadings phase of litigation; efficient case management is crucial to maximize the expense fund, preserve sellers’ rights, and optimize outcomes on earnouts or claims.

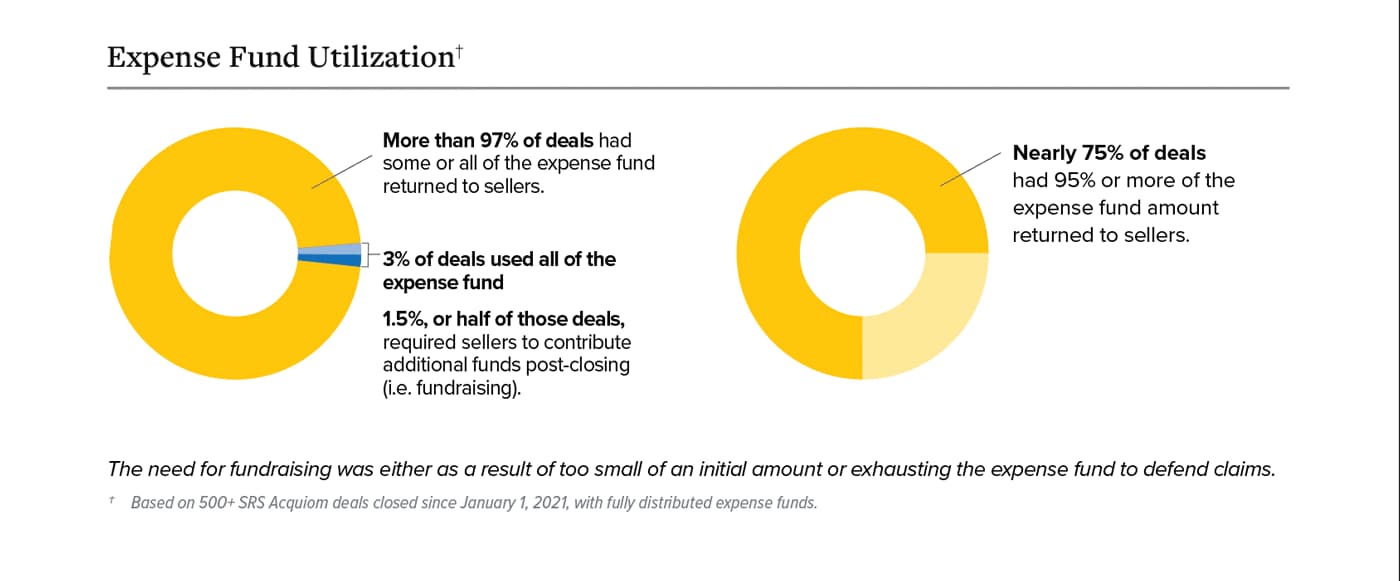

- When engaging a professional shareholder representative, ask about their typical M&A expense-fund utilization. A seasoned professional shareholder rep should minimally use the expense fund, if at all.

- How often are their clients’ expense funds nearly or fully depleted?

- How often do they ask their clients to replenish the expense fund? Fundraising is an arduous process often resulting in major and key investors contributing a disproportionate amount.

2. Who Controls? Ensure the M&A Expense Fund Is Put to Good Use

- Does the shareholder representative have complete discretion?

With a professional shareholder representative, the selling shareholders establish an advisory committee to provide direction on post-closing matters, including if and how to use the M&A expense fund.

- Will selling shareholders be kept apprised?

Remember, the expense fund belongs to the selling shareholders, and transparency is fundamental. The shareholder representative should regularly report on the status of post-closing matters, including the potential use of the expense fund.

- Does the shareholder representative have the experience, qualifications, and tools to manage expenditures?

Litigation budgets can be large and complex. Be sure that your shareholder representative has the experience and technology to establish and maintain reasonable spending parameters around any potential dispute.

3. Where Is the M&A Expense Fund Held? Ensure Security and Proper Bookkeeping

- Who will administer the M&A expense fund?

A professional shareholder representative should be able to hold and manage the expense fund for no additional cost to the sellers. - Will the funds be held securely?

M&A expense funds are typically held in custodial accounts with strong financial institutions. When an individual shareholder serves as the representative, there can be additional hassle and cost to administer the expense fund. Or worse, sometimes expense funds can get commingled with the individual’s personal assets.

Benefits of an Experienced Shareholder Representative

Ensuring the success of an M&A transaction should not overlook post-closing preparedness, which includes having an adequate expense fund to address claims or disputes. Early consideration of the critical elements of an expense fund is necessary. Don’t underestimate the experience of a professional shareholder representative, and make sure to understand how often the shareholder representative typically uses the expense fund versus their ability to handle issues in-house (included in their fee). All parties involved will benefit from a smooth and efficient post-closing experience.

Michelle Kirkpatrick

Executive Director, Shareholder Advisory tel:720-799-8614

Michelle leads the Shareholder Advisory team of attorneys and accountants handling post-closing issues, including escrow claims, earnouts, working capital, tax, and disputes. She has extensive experience negotiating, mediating, and litigating in various forums.

During her federal clerkship, Michelle participated in over 100 settlement conferences involving a wide variety of claims. Michelle then focused her practice at a leading labor and employment firm, where she specialized in drafting complex employment agreements and advising clients on a broad range of employment issues.

Michelle earned her JD from the University of California, Berkeley (Boalt Hall) and her BA in Political Science from the University of California, San Diego.