Deal-speed service. Global bank security. Get both, plus the industry’s most sophisticated and intuitive digital payments, with our integrated closing solutions.

M&A Escrow Agent

Service or security? Choose both.

SRS Acquiom combines the service of our experienced team with the fortress balance sheet of the world’s largest banks—all integrated with our other closing solutions. We keep your deal moving and your funds safe.

- Gain peace of mind knowing escrows are held at top-tier financial institutions including HSBC Bank.

- Licensed under the Payment Services Directive (PSD2) granted by The Dutch Central Bank, we provide a regulated escrow service, mitigating risk for both sides of the transaction.*

- Streamline with simplified KYC that's valid for three years after initial completion.

- Save time and energy with our intuitive Deal Dashboard plus an expert and responsive team.

- Pair our escrow service with payments and digital shareholder solicitation for a seamless approach.

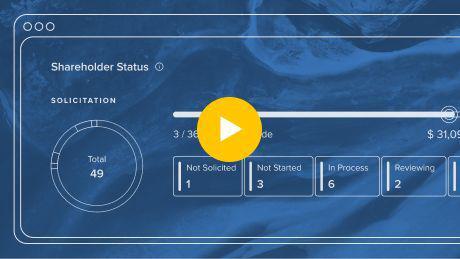

See how the SRS Acquiom Deal Dashboard creates a superior escrow and payments experience. Watch the video.

M&A Paying Agent

Bypass bureaucracy.

Driving deal efficiency is our core business—not a sideshow. Choose the industry’s most comprehensive and user-friendly M&A payments solution.

- Depend on the first, most experienced, and most advanced online M&A payments solution.

- Save time and cost with easy-to-set-up agreements and simple, online KYC that’s valid for three years.

- Send seller payments, debt payoffs, and transaction expenses in 130+ global currencies.

- Pair payments with digital shareholder solicitation and escrow administration for one seamless experience.

- Use SRS Acquiom Deal Dashboard™ to view real-time status of solicitation, payments, escrows, and more across all of your deals.

See how SRS Acquiom simplifies the payments process. Watch the video.

One system for the full deal lifecycle.

88% of global PE firms and 84% of top global VC firms have worked with SRS Acquiom to optimize their deals.**

Get in touch.

Want more information? Interested in a demo? Reach out to learn more.

Greg Nelson

Managing Director, Head of Sales

Request a Demo

Caspar Huith

Managing Director, Europe

Request a Demo

FEATURED INSIGHTS

Not All M&A Payees Are the Same: Tips for Payments in M&A Deals

Optimizing M&A Payments and Escrows for a Streamlined Client Experience

M&A Escrows: What You Need to Know