Topic

Format

Loan Agency

An Independent Administrative Agent or Facility Agent is Crucial to Your M&A Deal

Loan Agency

5 Steps to Close Your Next Deal with an Independent Administrative Agent or Facility Agent

Loan Agency

Tools for Practitioners

Checklist for Hiring a Successor Agent

Loan Agency

Best Practices When Hiring a Successor Agent for a Distressed Credit Facility

Loan Agency

Top Five Reasons to Use a Third-Party Loan Agent

Loan Agency

Insights from the Rise of Private Credit

Deal Terms Analysis

2024 M&A Deal Terms Study

Loan Agency

The Rise of SOFR as an Alternative to LIBOR: SOFR vs LIBOR

Loan Agency

Credit-Spread Adjustments and the State of SOFR Today

Loan Agency

Syndicated Loans: Financing the Future

Shareholder Representation

Professional Shareholder Representation Services Success Stories

Shareholder Representation

Including Deferred Tax Assets and Liabilities in Working Capital Calculations for M&A Transactions? Think Twice

Shareholder Representation

Three Best Practices for the M&A Expense Fund

Due Diligence

Best Practices in M&A Due Diligence Study

Loan Agency

Considerations When Selecting a Successor Agent

Tools for Practitioners

SRS Acquiom Barometer: 2024 M&A Outlook

Shareholder Representation

Are Your Client’s Proceeds at Risk From Post-Closing Claims?

Deal Terms Analysis

2024 M&A Working Capital PPA Study

Deal Terms Analysis

Why Are M&A Deal Parties Thinking Twice About RWI?

Deal Terms Analysis

M&A Earnouts: Be Prepared for 2024

Shareholder Representation

M&A Post-Closing Claims: Do Multipliers Apply?

Shareholder Representation

Expense Funds for the Win-Win

Tools for Practitioners

Due Diligence

Virtual Data Room Checklist: Four Tips for Choosing the Best M&A VDR Provider

Deal Terms Analysis

M&A Deal Terms: Three Trends to Watch in 2024

Due Diligence

What Makes a Modern Virtual Data Room?

Loan Agency

Restructuring Checklist: Navigating Turnarounds and Distressed Debt

Life Sciences

Life Sciences M&A: Are You Prepared for Post-Closing Challenges?

Shareholder Representation

Payments

M&A Expense Funds: Why Sellers Should Establish One, How Large It Should Be, and Other Considerations

Due Diligence

Enhance M&A Efficiency with a Private Client Portal

Loan Agency

Lending Industry Trends: Loans Remain Attractive as Market Resilience Persists

Shareholder Representation

Deal Terms Analysis

M&A Purchase Price Adjustments Are Common Yet Complex

Deal Terms Analysis

Valuation Disconnects Driving a Spike in Earnouts in M&A

Due Diligence

Shareholder Representation

M&A Deals: Don't Overlook the Later Stages

Loan Agency

Life After LIBOR: An Overview and Outlook

Life Sciences

2023 Life Sciences M&A Earnout Achievement: Key Findings by Industry Sector

Deal Terms Analysis

Lower Middle-Market Mergers & Acquisitions Deals Report

Deal Terms Analysis

Life Sciences

2023 SRS Acquiom Life Sciences M&A Study

Loan Agency

Lending in the Era of Uncertainty: Strategies for Success

Due Diligence

M&A Virtual Data Room Costs: Avoiding “Invoice Shock”

Deal Terms Analysis

2023 M&A Deal Terms and Trends for Private Equity Buyers

Deal Terms Analysis

Technology M&A Deal Terms and Trends

Deal Terms Analysis

Indemnification

Effect of Representations and Warranties Insurance on Deal Terms

Deal Terms Analysis

Due Diligence

Private M&A Deal Terms: An SRS Acquiom Quick Guide for M&A Advisors

Life Sciences

Life Sciences M&A: The Midyear Pulse

Deal Terms Analysis

Tools and Tactics for Getting Deals Across the Finish Line

Loan Agency

Weathering Volatility in the Leveraged Loan Market

Loan Agency

2023 Lending Considerations from Loan Experts - Survey Results

Shareholder Representation

The Importance of M&A Tax Advisory for Your Next Deal

Due Diligence

Shareholder Representation

M&A Deals Done Efficiently Webinar Summary: Preventable Pain Points in Private Mergers and Acquisitions

Payments

Not All M&A Payees Are the Same: Tips for Payments in M&A Deals

Deal Terms Analysis

Indemnification

Deal Terms for M&A Escrows - Statistics and Key Findings

Deal Terms Analysis

2023 M&A Deal Terms Study

Deal Terms Analysis

M&A Trends: PPAs and Claims Activity

Shareholder Representation

Avoiding M&A Risks - Maintaining Post-Closing Control

Indemnification

Shareholder Representation

The Problems with Pro Ratas in Mergers and Acquisitions

Loan Agency

A Distressed Loan Market Shouldn’t Cause Stress

Payments

Optimizing M&A Payments and Escrows for a Streamlined Client Experience

Indemnification

Influence of Representations and Warranties Insurance on Private Negotiations, Deal Terms, and Claims Activity

Payments

Cross-Border M&A Deals: Tips to Keep FX Simple

Tools for Practitioners

SRS Acquiom Barometer 2023 M&A Outlook

Life Sciences

Life Sciences M&A in 2023: Protecting Your Next Deal

Due Diligence

Shareholder Representation

Gaining M&A Efficiencies with Technology

Deal Terms Analysis

Post-Closing M&A Claims and Purchase Price Adjustments: Where Do They Stand Heading Into 2023?

Deal Terms Analysis

2022 PE-Buyer Deal Terms

Due Diligence

Tools for Practitioners

M&A Due Diligence Checklist

Loan Agency

Context for SOFR as Rates Shift

Due Diligence

Shareholder Representation

Deals Done Efficiently: Four Things M&A Advisors Need to Know

Indemnification

Stock Escrows: Structure Matters When Using Buyer Equity in M&A Transactions

Loan Agency

Term SOFR Adds Appeal to LIBOR Alternative

Deal Terms Analysis

Due Diligence

How M&A Advisors Use Deal Data to Improve the Due Diligence Process

Payments

M&A Paying Agent Agreements: Who Pays the Fees?

Loan Agency

Rising Interest Rates and Restructuring Effects — SRS Acquiom Barometer

Due Diligence

Shareholder Representation

The Use of Technology in M&A

Deal Terms Analysis

2022 M&A Deal Terms Study Update with Key Findings

Shareholder Representation

Due Diligence

M&A Advisors: Why is a Post-closing Specialist Essential for Your Clients?

Shareholder Representation

Due Diligence

Tools for Practitioners

Pre-Closing M&A Checklist For Advisors

Shareholder Representation

Indemnification

Mitigate Costly Post-Closing Claims

Deal Terms Analysis

Indemnification

2022 M&A Claims Insights Report

Loan Agency

Smarter Navigation: Loan Restructuring Study 2022

Shareholder Representation

M&A Merger Agreements: Efficient Drafting

Indemnification

M&A Escrows: Streamlining the Post-Closing Process

Indemnification

A Primer on Representations and Warranties Insurance

Shareholder Representation

Purchase Price Adjustments: Insider Tips for Better M&A Merger Agreements

Loan Agency

Bilateral Loans vs. Syndicated Loans: What’s the Difference?

Shareholder Representation

Due Diligence

Can M&A Advisory Clients Benefit from a Professional Shareholder Rep?

Indemnification

Payments

Due Diligence

M&A Advisory Clients: How to Distribute Post-Closing Funds More Efficiently

Deal Terms Analysis

2022 Technology M&A Deals Special Report

Indemnification

Effect of Reps and Warranties Insurance (RWI) on Deal Terms

Payments

Ten Tips for Avoiding Delays in M&A Payments

Shareholder Representation

Indemnification

Anatomy of a Purchase Price Adjustment Provision In M&A Agreements

Loan Agency

Predatory Priming: Three Steps to Protect Your Lien Position

Shareholder Representation

Indemnification

Scheduled Litigation Risks in Mergers and Acquisitions: Tips to Manage Third-Party Lawsuits

Shareholder Representation

M&A Negotiation & Scheduled Litigation: Deal Terms for Managing Third-Party Lawsuits

Shareholder Representation

Challenges and Tips to Protect the M&A Deal Process & Parties

Shareholder Representation

Cannabis M&A Deals — Post-Closing Challenges

Loan Agency

What to Do When Your Administrative Agent Resigns

Loan Agency

Rising Interest Rates and the War in Ukraine: What is the Impact on Commercial Loans?

Loan Agency

Administrative Agent Resignation Checklist

Deal Terms Analysis

2022 M&A Deal Terms Study

Payments

Faster and More Efficient M&A Payments — 4 Simple Steps

Shareholder Representation

Negotiating the M&A Purchase Price Adjustment Provision

Tools for Practitioners

Shareholder Representation

Interest Rates, Ukraine, and M&A Impacts — SRS Acquiom Barometer

Payments

Professional Paying Agent - Four Easy Ways to Safeguard Faster and Efficient M&A Payments at Closing

Shareholder Representation

Key Insights for Engaging a Shareholder Representative

Life Sciences

Top M&A Milestones: The COVID Impact

Loan Agency

2022 Bankruptcy Filings Outlook

Indemnification

Payments

M&A Escrows and Payments — What to Know

Life Sciences

Life Sciences M&A in a Pandemic World

Shareholder Representation

Indemnification

How to Protect Deal Parties in Cannabis M&A Deals

Shareholder Representation

Optimizing Outcomes for M&A Post-Closing Purchase Price Adjustments and Net Working Capital

Tools for Practitioners

Shareholder Representation

SRS Acquiom Barometer Impact of Current U.S. Tax Proposals on M&A

Payments

Data Security and Payments Compliance for Private Equity: Five Tips to Keep Your Deals in the Clear

Loan Agency

Life After LIBOR: Recommendations for an Orderly Transition

Deal Terms Analysis

2021 Life Sciences M&A Study

Loan Agency

The Current State of Leveraged Loans in the Middle Market

Shareholder Representation

An Examination of Evolving Employment Challenges and Solutions in M&A

Shareholder Representation

Working Capital Purchase Price Adjustment Mechanics — Avoid Costly Disputes

Deal Terms Analysis

Shareholder Representation

2021 M&A Deal Terms Study Key Findings

Due Diligence

Shareholder Representation

Environmental, Social, and Governance Factors and Their Influence on M&A Activities — SRS Acquiom Barometer

Loan Agency

Should Alternative Lenders Be Loan Agents?

Shareholder Representation

Indemnification

Effective Dispute Resolution

Deal Terms Analysis

2021 M&A Deal Terms Study

Shareholder Representation

Payments

M&A Expense Fund Key Concepts

Loan Agency

LIBOR Cessation Update: What It Means for Your Business

Shareholder Representation

SPACs on the Rise: Are They Right for Your Next M&A Deal?

Shareholder Representation

Best Practices: Shareholder Representative Services

Life Sciences

Shareholder Representation

How to Structure Earnouts in M&A

Shareholder Representation

M&A Closing: How to Make the Distribution of Post-Closing Funds More Efficient

Loan Agency

Top 5 Sub-Agent Duties in a Loan Transaction

Shareholder Representation

Key Concepts When Calculating Purchase Price Adjustments

Deal Terms Analysis

2020 M&A Claims Insights Report

Loan Agency

Collateral Priming: Steps Lenders Can Take Against Predatory Practices

Payments

5 Foreign Exchange Tips for Your Next Cross-Border M&A Deal

Payments

How Your M&A Deal Treats the Payout of Employee Stock Options Can Have Significant Payroll Tax Implications

Deal Terms Analysis

Shareholder Representation

What to Make of the Great Hill Case – The M&A Bar is Not Yet in Agreement on How Best to Address Merger Agreement Privilege Issues

Shareholder Representation

Payments

$5 Billion Found: Solving for the Administrative Inefficiencies in M&A

Shareholder Representation

Tools for Practitioners

Venture Capital (VC) M&A Checklist: Post-Close Drafting Considerations

Deal Terms Analysis

2020 Review: COVID-19 Impact on M&A Transactions

Deal Terms Analysis

M&A Deal Terms & Trends Pre- & Post-COVID-19

Life Sciences

Shareholder Representation

A Review of Earnouts in M&A Transactions

Deal Terms Analysis

Shareholder Representation

M&A: Who Owns the Attorney-Client Privilege After Closing?

Payments

Managing Foreign Exchange (FX) Complexities in International M&A Transactions

Shareholder Representation

Common Myths About Hiring a Professional Shareholder Representative

Shareholder Representation

Keeping Investment Funds Out of Litigation Purgatory With a Professional Shareholder Representative

Shareholder Representation

Guidance on Shareholder Rep Expense Fund - Why a Properly Sized Expense Fund Can Be Good for M&A Buyers and Sellers

Shareholder Representation

How Private Equity Manages the Post-Closing M&A Process

Shareholder Representation

Effective M&A Dispute Resolution: Considerations in Arbitration, Litigation

Deal Terms Analysis

2020 Buy-Side Reps and Warranties Insurance Deal Terms Update

Shareholder Representation

COVID-19 M&A Post-Closing Scenarios

Loan Agency

Distressed-Debt Market Trends

Indemnification

Payments

M&A Payments & Escrow: Five Ways to Reduce Pain Points

Payments

The High Cost for M&A Deal Parties with Foreign Exchange

Life Sciences

How COVID-19 is Impacting Life Sciences M&A Post-Close

Shareholder Representation

Strategies for Addressing Pre-Closing Sales & Use Tax Liabilities

Shareholder Representation

Managing M&A Earnouts in a Pandemic

Deal Terms Analysis

A First Look at the Impacts of Coronavirus on M&A Transactions

Indemnification

Will COVID-19 Affect Your Ability to Secure RWI Indemnification?

Shareholder Representation

Due Diligence

Transformation, Efficiency, Opportunity: Transactional Technology in M&A

Tools for Practitioners

Shareholder Representation

Anatomy of the Target Company Privilege Provision in M&A Agreements

Shareholder Representation

5 Reasons a Selling Shareholder Should Not Volunteer to Be the Shareholder Rep

Indemnification

Payments

M&A Deals: How LOTs Have Changed (or Not) Five Years After Cigna v. Audax

Tools for Practitioners

Shareholder Representation

Buyer Power Ratio

Deal Terms Analysis

Life Sciences

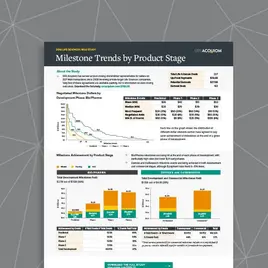

Life Sciences: Milestone Trends by Product Stage

Deal Terms Analysis

Life Sciences

Life Sciences: Timeline of Milestone Payments

Deal Terms Analysis

Shareholder Representation

Addressing Target Company Privilege in Merger Agreements Five Years after Great Hill v. SIG

Loan Agency

The End of LIBOR - How to Prepare

Life Sciences

Deal Terms Analysis

Shareholder Representation

Life Sciences M&A: Private Target Deal Trends

Shareholder Representation

Tools for Practitioners

Working Capital Adjustment M&A Checklist and Guidelines

Indemnification

Reps & Warranties Insurance (RWI): Is It Changing the (M&A) World?

Deal Terms Analysis

Shareholder Representation

Beware of Exclusions When Defining Net Working Capital in M&A Transactions

Payments

Taxation of Interest Earned on the M&A Escrow Account: Actual vs. Imputed

Tools for Practitioners

Shareholder Representation

M&A Seller Checklist: Post-Close Drafting Considerations

Loan Agency

Five Considerations for Engaging with an Administrative Agent

Indemnification

What's Best for Your Deal? Escrow vs Reps & Warranties Insurance

Loan Agency

A New Standard: How Financial Institutions are Racing to Prepare for the LIBOR Transition

Shareholder Representation

Five Common Reasons for Disputes in Working Capital

Loan Agency

LIBOR to SOFR in the Syndicated Loan Market

Deal Terms Analysis

Life Sciences

2019 Life Sciences Study Quick Reference Guide

Loan Agency

What is Loan Agency? What is an Administrative Agent?

Loan Agency

Loan Agency Services - The Value of the Administrative Agent (Timeliness, Trades, and Taxes)

M&A Escrow Agreement: Key Considerations When Negotiating

Deal Terms Analysis

Life Sciences

2019 Life Sciences M&A Study

Indemnification

Reps & Warranties Insurance (RWI) Fast Facts

Shareholder Representation

Indemnification

The Impact of Buy-Side RWI on Buyer Indemnification Efforts

Indemnification

The Rise of Representations and Warranties Insurance

Shareholder Representation

Watch Out for Legal Issues in Purchase Price Adjustments

Tools for Practitioners

Indemnification

Shareholder Representation

Tales from the M&A Trenches, 5th edition

Payments

Paying Agent Agreement - Five Important Considerations When Negotiating

Shareholder Representation

Indemnification

Purchase Price Adjustments in Light of Chicago Bridge and Rep and Warranty Insurance

Shareholder Representation

M&A Privilege: What to Make of the Great Hill Case— Who Owns the Attorney-Client Privilege After Closing and How Can it Really be Addressed?

Shareholder Representation

Does Your M&A Client Need a Professional Shareholder Rep?

Shareholder Representation

Does Your M&A Deal Need a Professional Shareholder Rep?

Deal Terms Analysis

2018 M&A Claims Insights Report

Shareholder Representation

Purchase Price Adjustments: Setting the Net Working Capital Target

Indemnification

Indemnification Solutions Come of Age

Shareholder Representation

Professional Shareholder Representation–A Must for Sellers

Indemnification

Payments

The Do’s and Don’t’s of Pro-Rata Share Ownership

Indemnification

Concern Over New Rules Requiring Disclosure of Personal Information

Payments

M&A Payments Trends

Payments

How to Handle Compensatory Payments Post-Closing

Deal Terms Analysis

Shareholder Representation

Understanding Changes in Shareholder Consent Requirements

Deal Terms Analysis

Shareholder Representation

Impact of “Buyer Power Ratio” on M&A Deal Terms

Indemnification

Shareholder Representation

Payments

Unexpected Drains on Private Equity Productivity

Shareholder Representation

Mind the Gap: The Space Between a Post-Closing PPA and R&W Insurance

Indemnification

Escrows vs. Representations and Warranties Insurance (RWI M&A)

Shareholder Representation

Indemnification Claim or Working Capital Adjustment? OSI Systems v. Instrumentarium

Tools for Practitioners

Due Diligence

Pre-Closing Checklist for M&A Seller Management

Shareholder Representation

Understanding the Role of the Purchaser Representative in Stock-for-Stock Transactions

Shareholder Representation

Selling Residual Interest to Write Off Investment Losses

Shareholder Representation

Sales Taxes: Whose Tax is it, Anyway?

Shareholder Representation

Payments

Contribution and Joinder Agreements

Shareholder Representation

Payments

Shareholder Releases and Letters of Transmittal

Indemnification

Distribution of Escrow Release Payments

Payments

M&A: Tax Reporting and Payments to Employees

Indemnification

Perfected Security Interest in Escrow Funds

Payments

Cross-Border Transactions; Watch Out for FBAR

Indemnification

Indemnification Escrow: Who Should Indemnify the Escrow Bank?

Payments

M&A Paying Agent - How Best to Effect Payments

Indemnification

Insurance-backed M&A Escrow Solutions vs. Traditional Bank Products

Indemnification

Shareholder Representation

Avoiding Improper Lock-up of Escrow Money

Shareholder Representation

Working Capital Definition

Deal Terms Analysis

Shareholder Representation

Clarifying When Attorneys’ Fees Constitute Damages

Shareholder Representation

Preparing and Filing Tax Returns

Deal Terms Analysis

Shareholder Representation

M&A Conflict Waivers

Payments

Legal Opinion Paves Way for Paperless Closings & Online Payments

Shareholder Representation

Payments

Disbursement of Funds—Who Touches the Money?

Shareholder Representation

Enforceability of Representation and Warranty Survival Periods—Western Filter v. Argan

Shareholder Representation

Assuming Defense of Third-Party Claims: the Moral Indemnity Hazard Problem

Deal Terms Analysis

Shareholder Representation

Do Carveouts to Caps Work the Way You Intend?

Shareholder Representation

Damages Based on Financial Misstatements

Deal Terms Analysis

Shareholder Representation

Definition of Purchase Price