Format

Loan Agency

Loan Liquidity Allows Accessibility: What You Need to Know

Loan Agency

Trends in Loan Agency and Regulatory Compliance

Loan Agency

The Contest for Capital: Private Credit vs Broadly Syndicated Loans 2024

Loan Agency

Five Considerations When Engaging an Administrative or Facility Agent

Loan Agency

Lack of Supply, Competition Leads to Tighter Spreads

Loan Agency

Deflated Default Rate May Not Tell the Whole Story

Loan Agency

Peaceful Coexistence: Evolving Private Credit Market Shows Similarities to BSL Market

Loan Agency

Liability Management Transactions are Poised to Proliferate: What You Need to Know

Loan Agency

Uptiering: Steps Lenders Can Take Against Predatory Practices

Loan Agency

Predatory Uptiering: Three Steps to Protect Against Being Primed

Loan Agency

The Importance of Loan Portability: What You Need to Know

Loan Agency

2024 Loan Agency Restructuring and Liquidity Considerations

Loan Agency

An Independent Administrative Agent or Facility Agent is Crucial to Your Deal

Loan Agency

5 Steps to Close Your Next Deal with an Independent Administrative Agent or Facility Agent

Loan Agency

Tools for Practitioners

Checklist for Hiring a Successor Agent

Loan Agency

Best Practices When Hiring a Successor Agent for a Distressed Credit Facility

Loan Agency

Top Five Reasons to Use a Third-Party Loan Agent

Loan Agency

Insights from the Rise of Private Credit

Loan Agency

The Rise of SOFR as an Alternative to LIBOR: SOFR vs LIBOR

Loan Agency

Credit-Spread Adjustments and the State of SOFR Today

Loan Agency

Syndicated Loans: Financing the Future

Loan Agency

What is Loan Agency? What is an Administrative Agent?

Loan Agency

Bilateral Loans vs. Syndicated Loans: What’s the Difference?

Loan Agency

Considerations When Selecting a Successor Agent

Loan Agency

Restructuring Checklist: Navigating Turnarounds and Distressed Debt

Loan Agency

Lending Industry Trends: Loans Remain Attractive as Market Resilience Persists

Loan Agency

Life After LIBOR: An Overview and Outlook

Loan Agency

Lending in the Era of Uncertainty: Strategies for Success

Loan Agency

Weathering Volatility in the Leveraged Loan Market

Loan Agency

2023 Lending Considerations from Loan Experts - Survey Results

Loan Agency

A Distressed Loan Market Shouldn’t Cause Stress

Loan Agency

Context for SOFR as Rates Shift

Loan Agency

Term SOFR Adds Appeal to LIBOR Alternative

Loan Agency

Rising Interest Rates and Restructuring Effects — SRS Acquiom Barometer

Loan Agency

Smarter Navigation: Loan Restructuring Study 2022

Loan Agency

What to Do When Your Administrative Agent Resigns

Loan Agency

Rising Interest Rates and the War in Ukraine: What is the Impact on Commercial Loans?

Loan Agency

Administrative Agent Resignation Checklist

Loan Agency

2022 Bankruptcy Filings Outlook

Loan Agency

Life After LIBOR: Recommendations for an Orderly Transition

Loan Agency

The Current State of Leveraged Loans in the Middle Market

Loan Agency

Should Alternative Lenders Be Loan Agents?

Loan Agency

LIBOR Cessation Update: What It Means for Your Business

Loan Agency

Top 5 Sub-Agent Duties in a Loan Transaction

Loan Agency

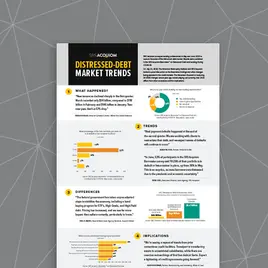

Distressed-Debt Market Trends

Loan Agency

The End of LIBOR - How to Prepare

Loan Agency

A New Standard: How Financial Institutions are Racing to Prepare for the LIBOR Transition

Loan Agency

LIBOR to SOFR in the Syndicated Loan Market

Loan Agency

Loan Agency Services - The Value of the Administrative Agent (Timeliness, Trades, and Taxes)